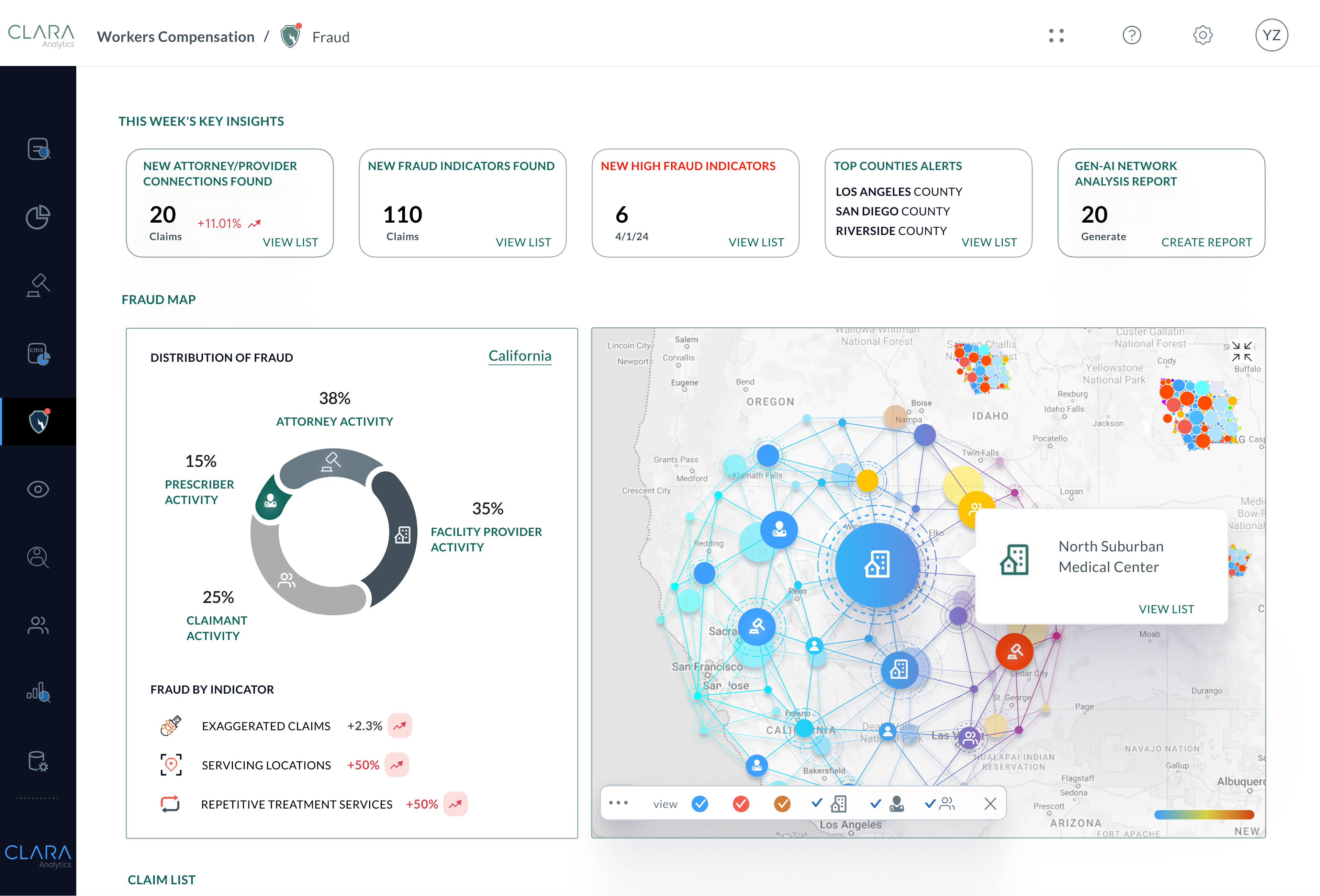

Identify Suspicious Medical & Legal Activity

Suspected Fraudulent Behavior Insights for SIU Referrals

CLARA Fraud analyzes claims data, billing records and legal demands using fraud risk scoring to alert and provide justification for SIU referrals. Eliminate false positives and uncover fraudulent activity from bad actors across millions of claims.

Identify Suspicious Activity Invisible to the Human Eye

Humans cannot keep tabs on every attorney, medical provider, and claimant, making it virtually impossible to examine the vast number of cases needed to identify patterns of fraud. Let AI-powered fraud risk scoring and claims fraud analysis tools do this for you.

Augmented Intelligence Learns from Millions of Claims

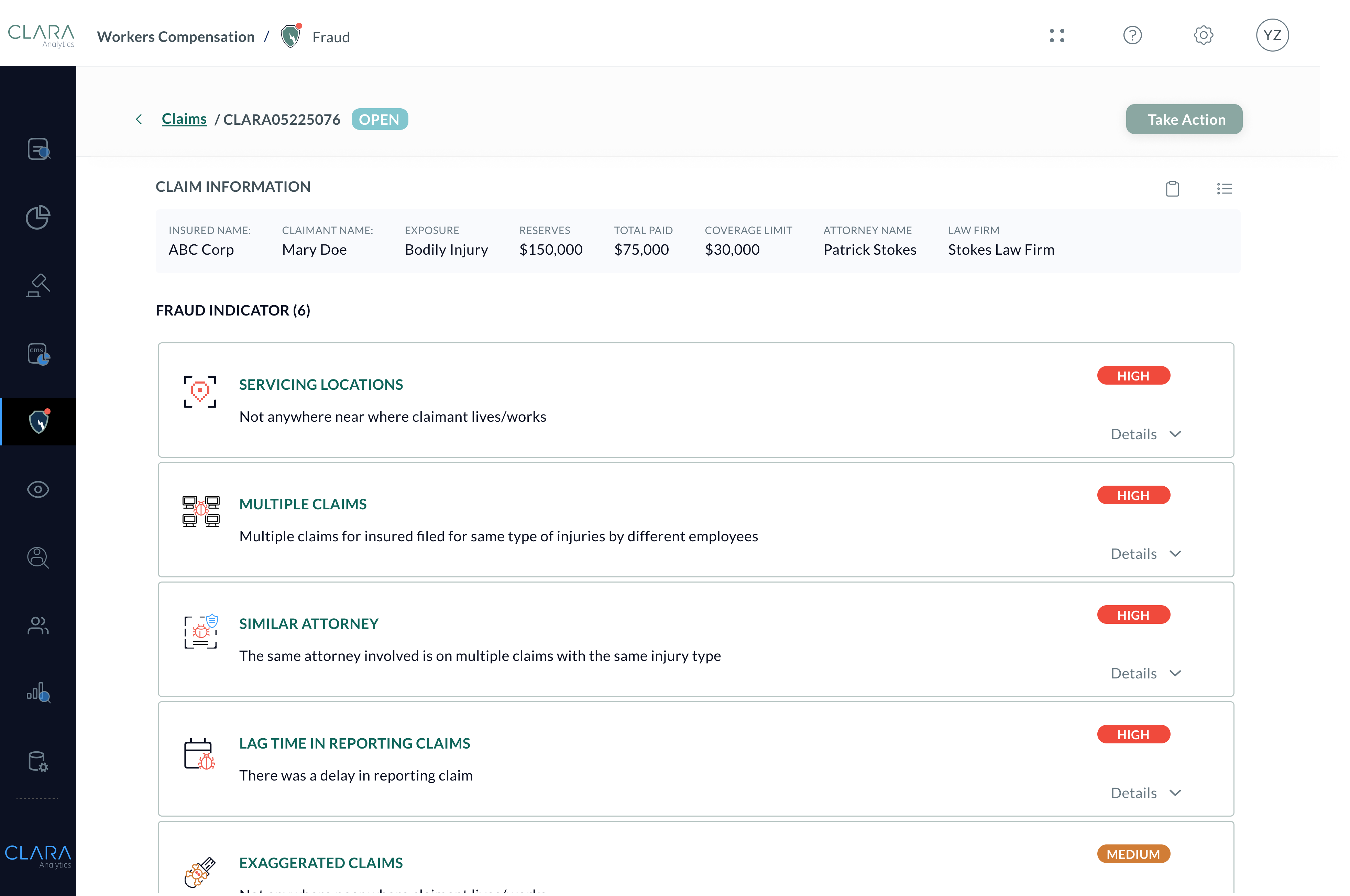

CLARA Fraud adds a second set of eyes on all of your claims by alerting on cumulative fraud indicators across all claims on the CLARA platform. Let AI expose fraud patterns that even the most senior adjuster could miss.

Stop Bad Actors Quickly and Confidently

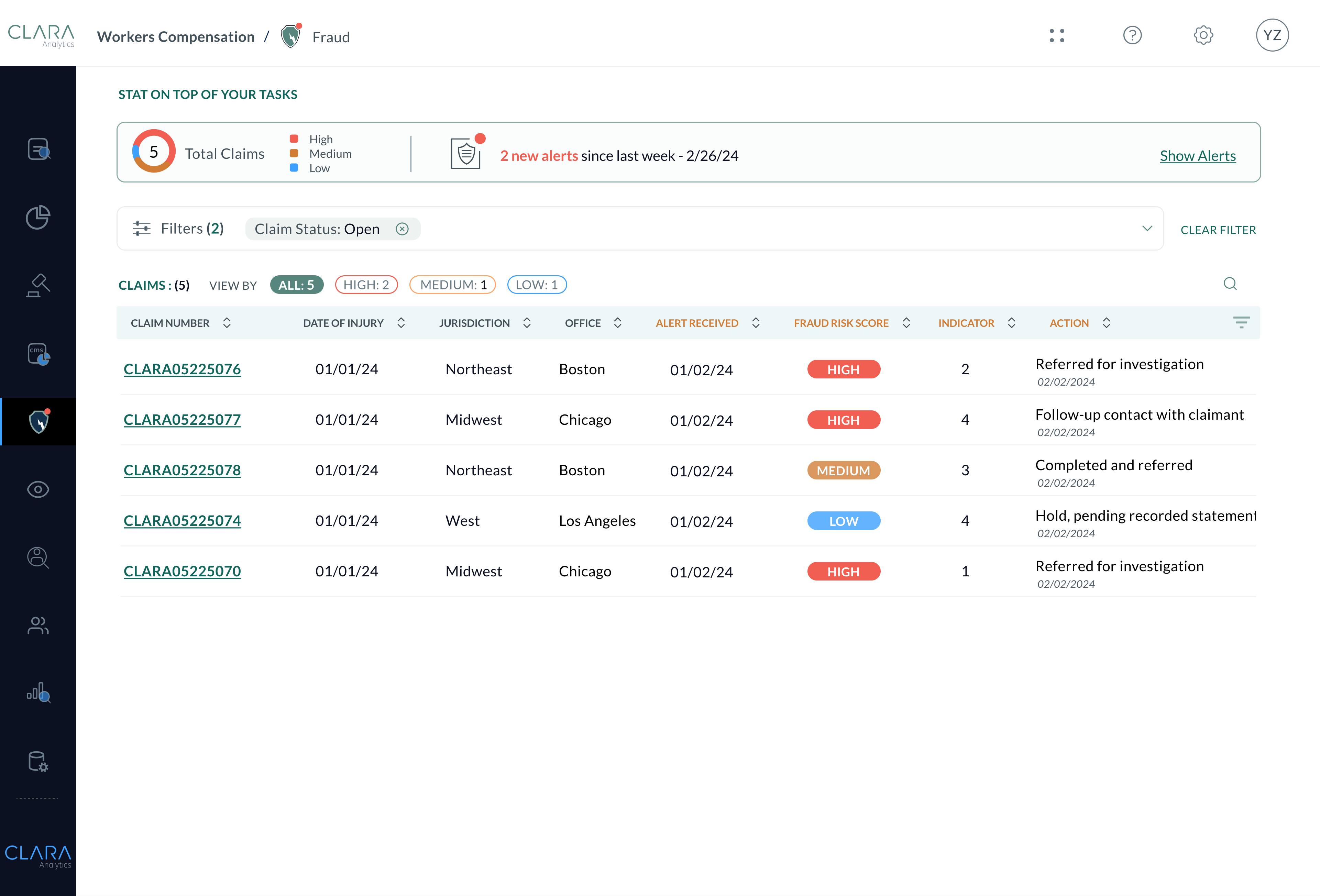

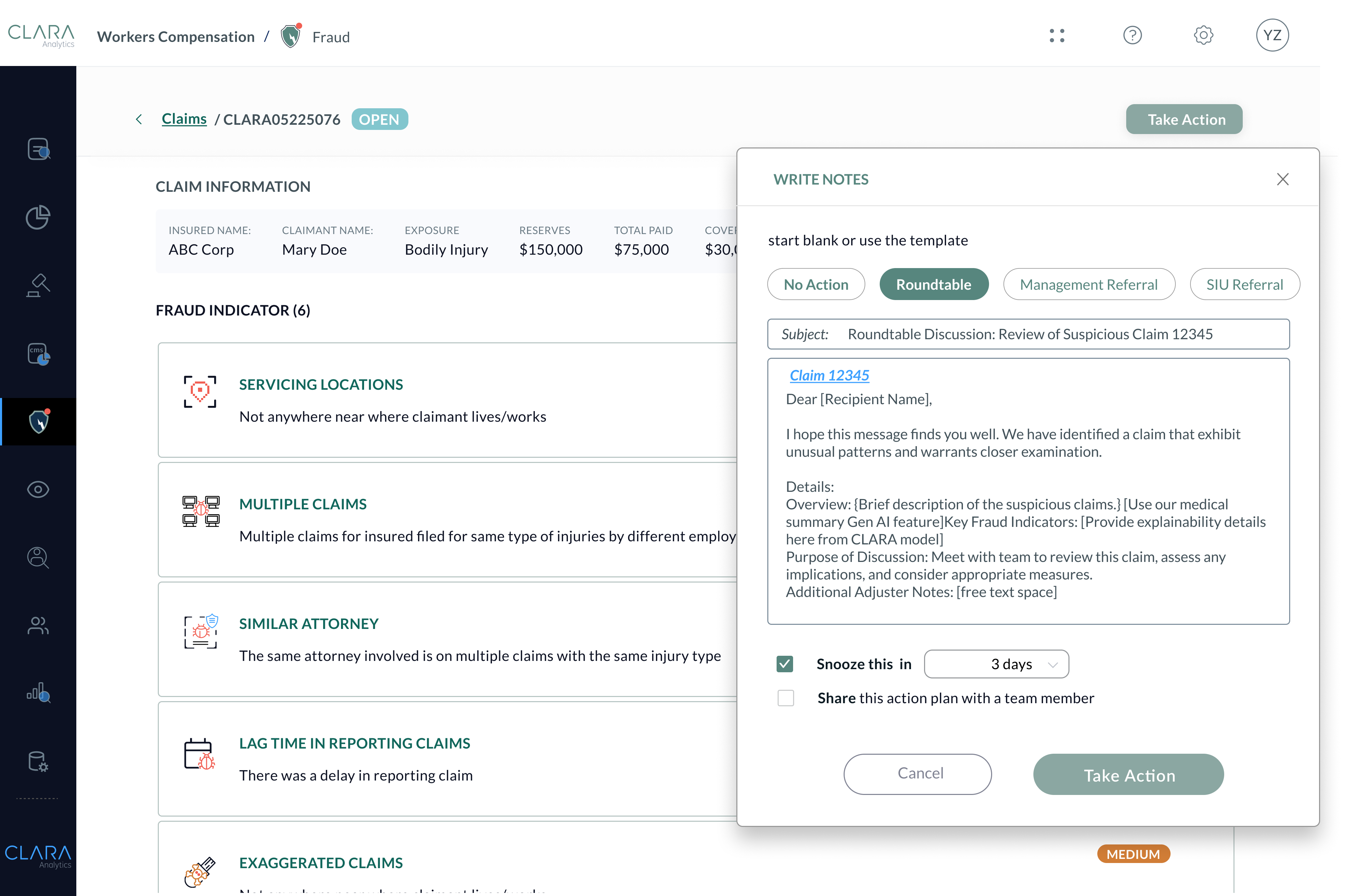

Anyone handling a claim can benefit from CLARA Fraud’s speed and accuracy. Feel confident in your SIU and claims management referrals, avoid false positives, and avoid unnecessary loss costs. Use AI-driven fraud detection to justify investigation referrals and stop bad actors.

Key Benefits

- Identify Systemic Fraud Across Workers Compensation Claims with AI Fraud Prevention

- Streamline SIU referrals with data-informed justification

The Result?

- Improved referral acceptance rate

- Lower claim operational costs

- Optimized claim outcomes

Ideal For

- Investigative Units

- Roundtable Teams

- Claims Adjusters

- Legal Teams

Detect systemic patterns of suspicious behavior