Minimize the Impact of Litigation with AI

More favorable legal outcomes and lower claim costs

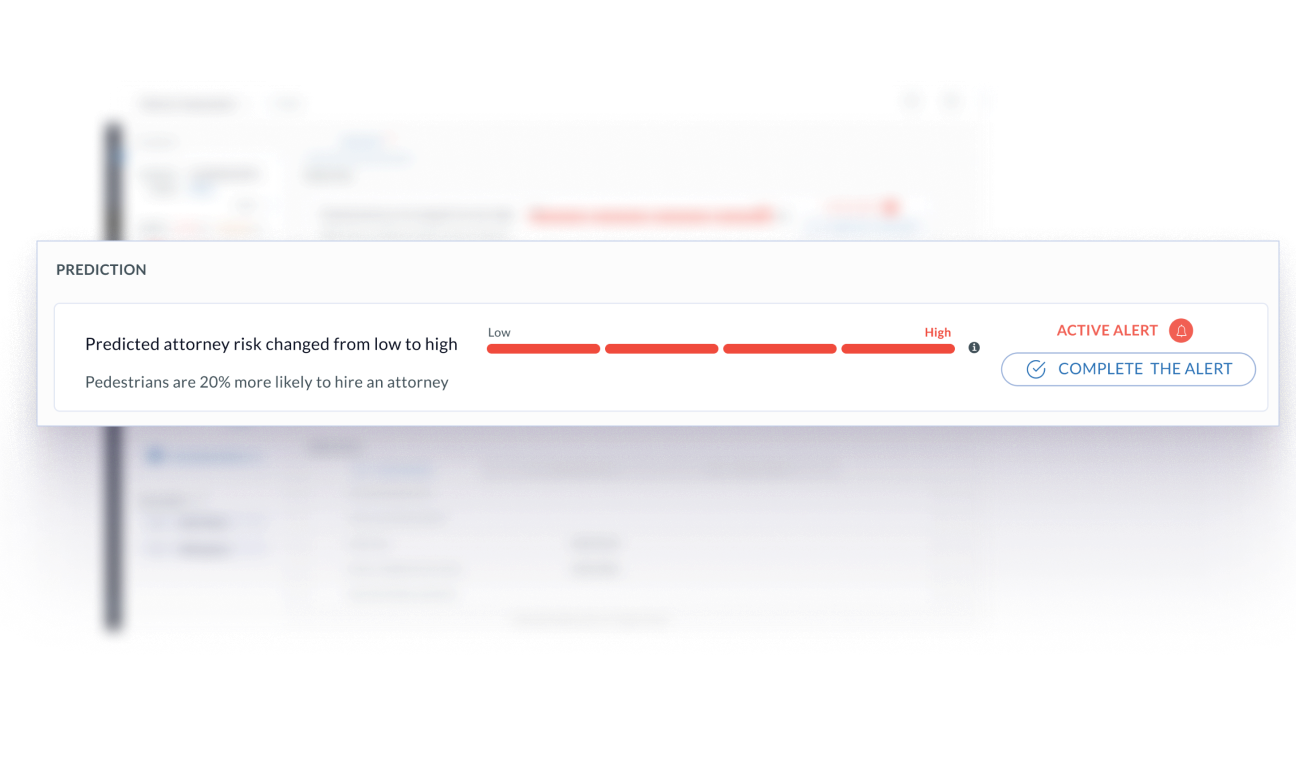

Augmented Intelligence for Litigation Risk Prediction

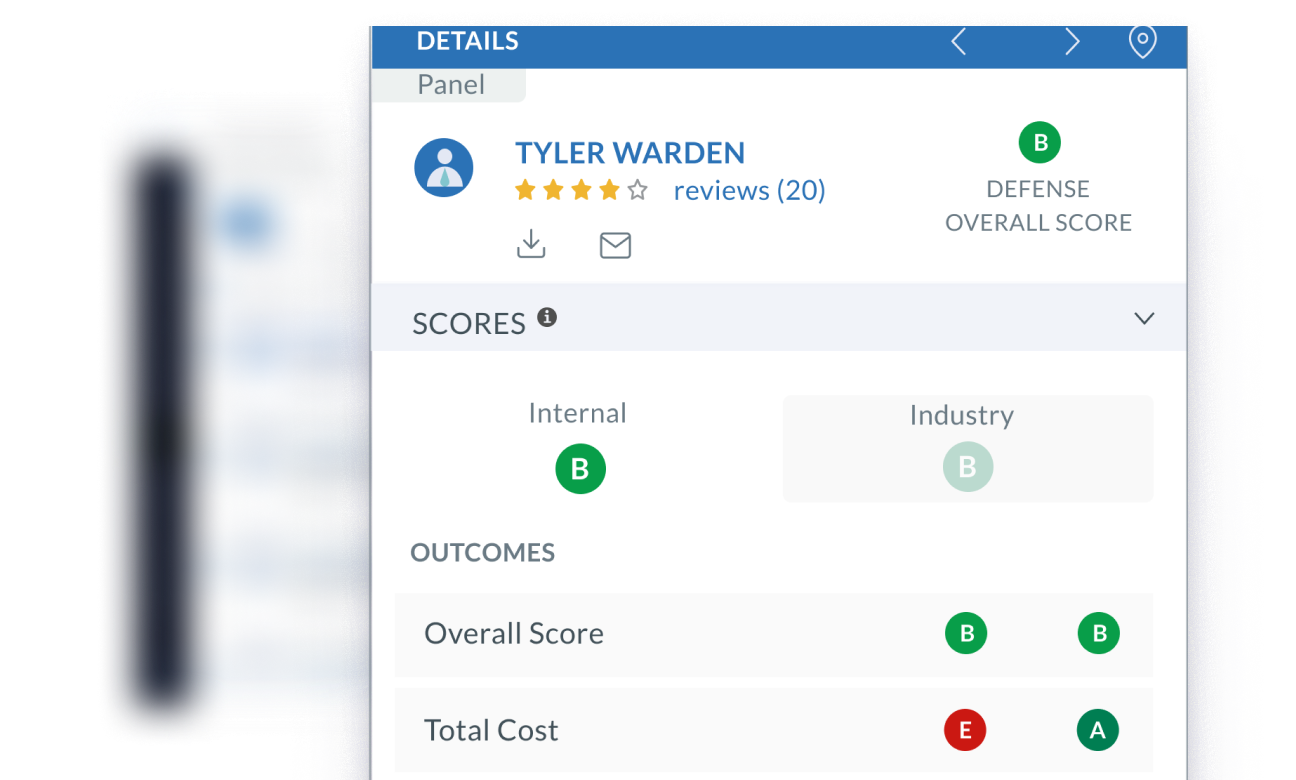

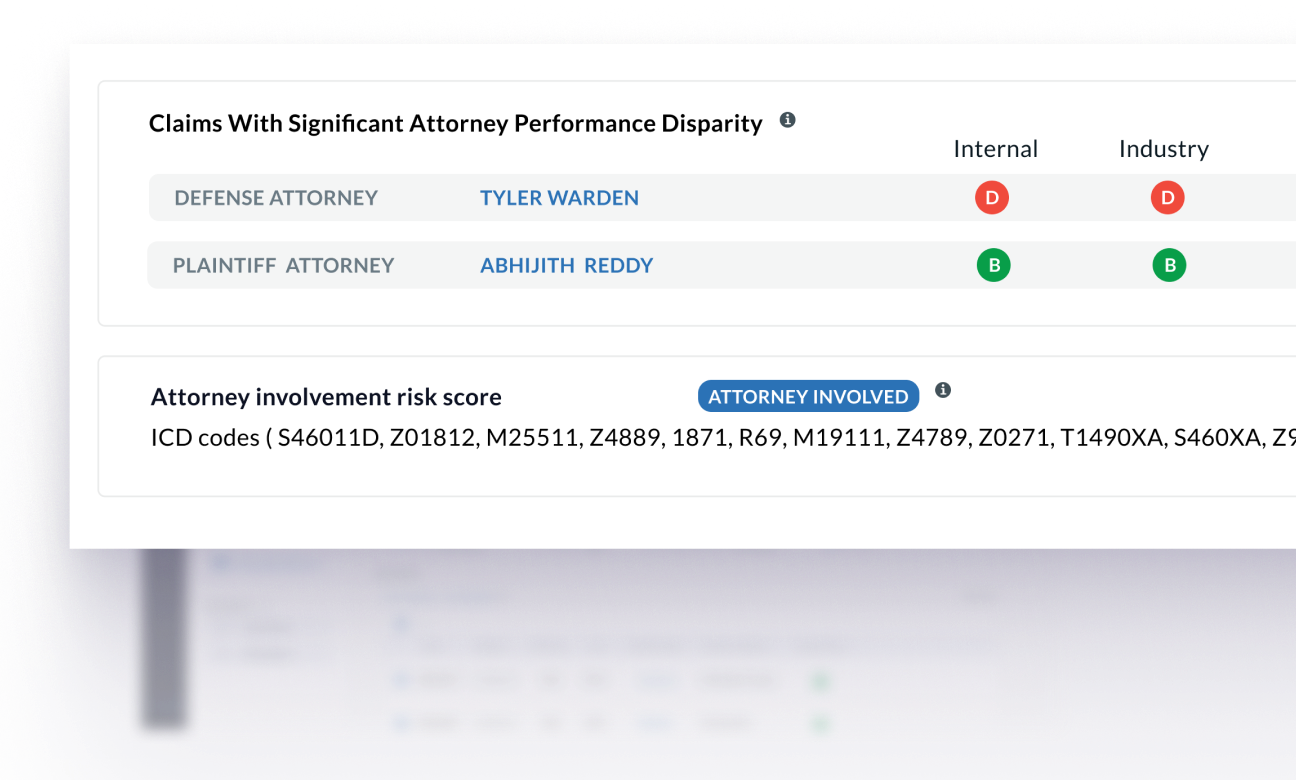

CLARA Litigation looks at attorney outcomes on prior claims and scores them based on factors like performance and cost. Adjusters can detect litigation risk, manage attorney performance, and resolve claims effectively by keeping their current counsel focused on a claim or choosing a better fit from a list of high-scoring attorneys nearby. Legal panel managers can benchmark current panels and optimize their mix based on their scores.

Augmented Intelligence that Saves Customers Millions in Indemnity Expenses Annually

Our research found that for casualty claims with attorney involvement, the average indemnity costs are 390% higher than for unrepresented claims ($77,807 vs. $15,936). Claim duration is 295% higher. Fight social inflation with augmented intelligence.

Augmented Intelligence for Workers Comp, Commercial Auto and General Liability Claims

Social inflation and increased attorney involvement are hurting loss ratios across the casualty lines of business. Empower your claims organization and legal counsel with the intelligence to play legal “Moneyball” against plaintiff firms and third-party-funded litigation.

Key Benefits

- Lower Attorney Involvement

- Optimized Legal Strategies

The Result?

- Indemnity expense reduction

- Loss cost reductions

Ideal For

- Claim adjusters

- Legal teams

Reduce The Cost And Impact Of Litigation