Products

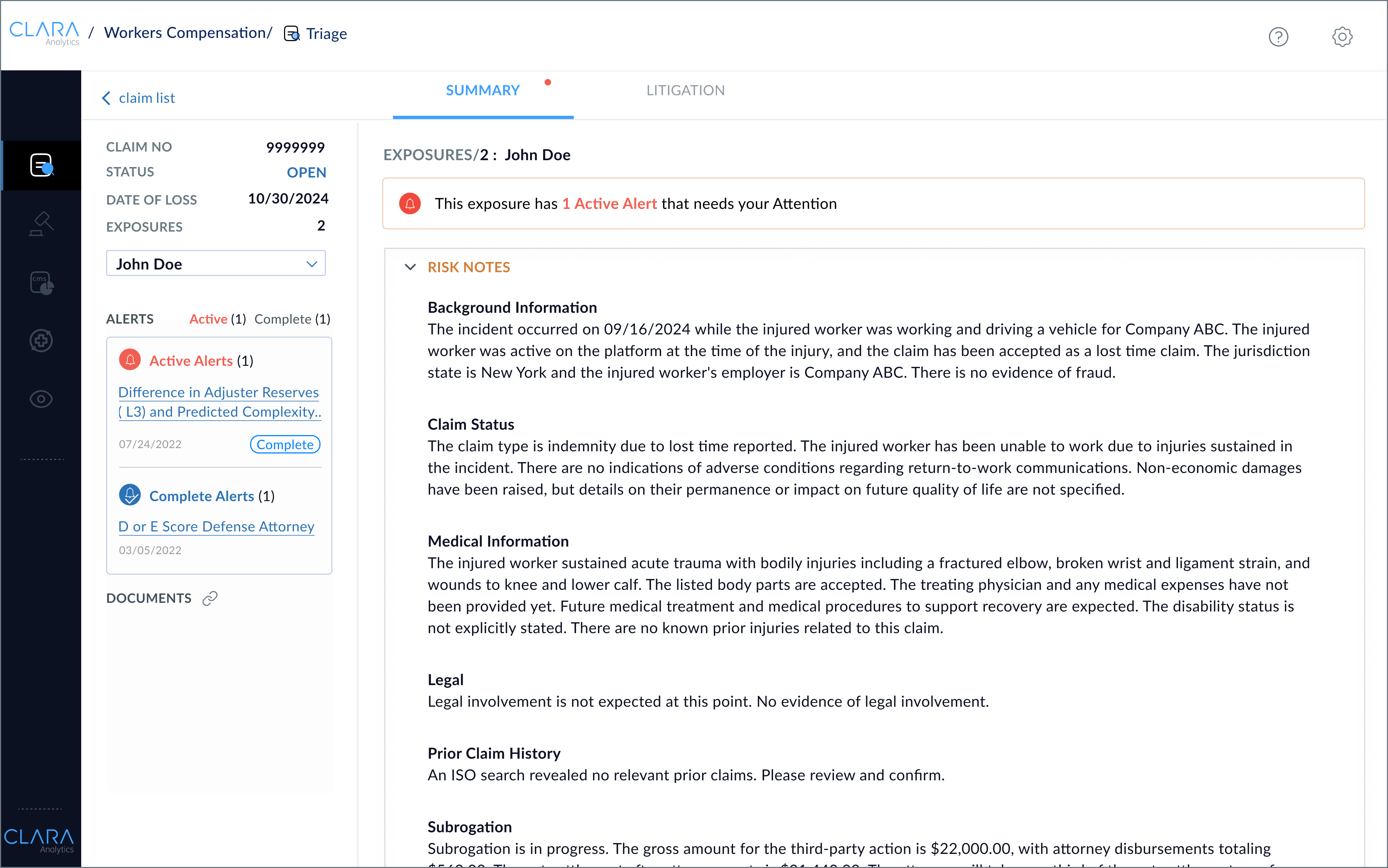

CLARA Triage

Focus on the right claims and take action

CLARA Triage, now with subrogation opportunity detection, employs artificial intelligence (AI) to help adjusters detect and proactively manage casualty claims, driving focus to claims that need attention and streamlining the claims that don’t.

Keep Every Claim

On The Optimal Path

CLARA Triage predicts claim severity based on years of prior claims, identifies tightly defined cohorts that yield insights about the future direction of a claim, and reduces claims cycles and loss costs through AI claim reviews.

Expedite Simple Claims and Monitor Complex Claims to Prevent Escalation

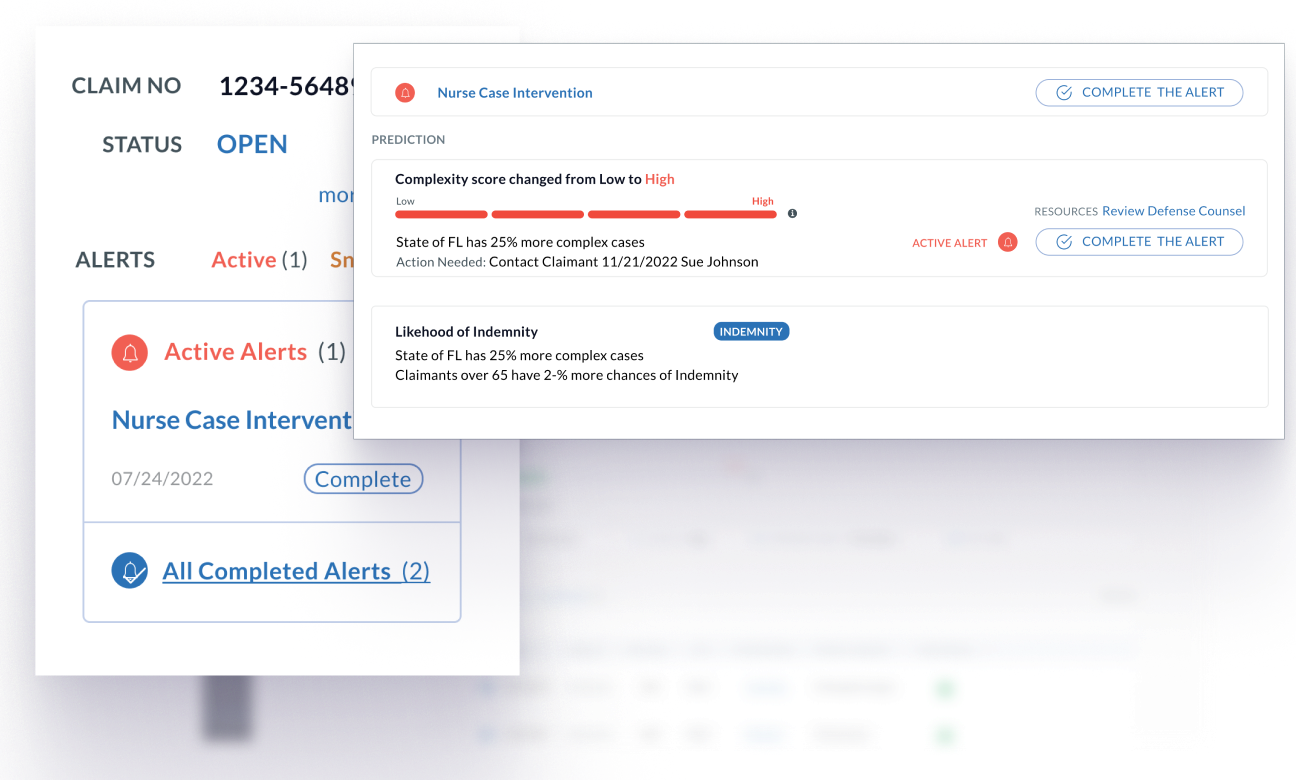

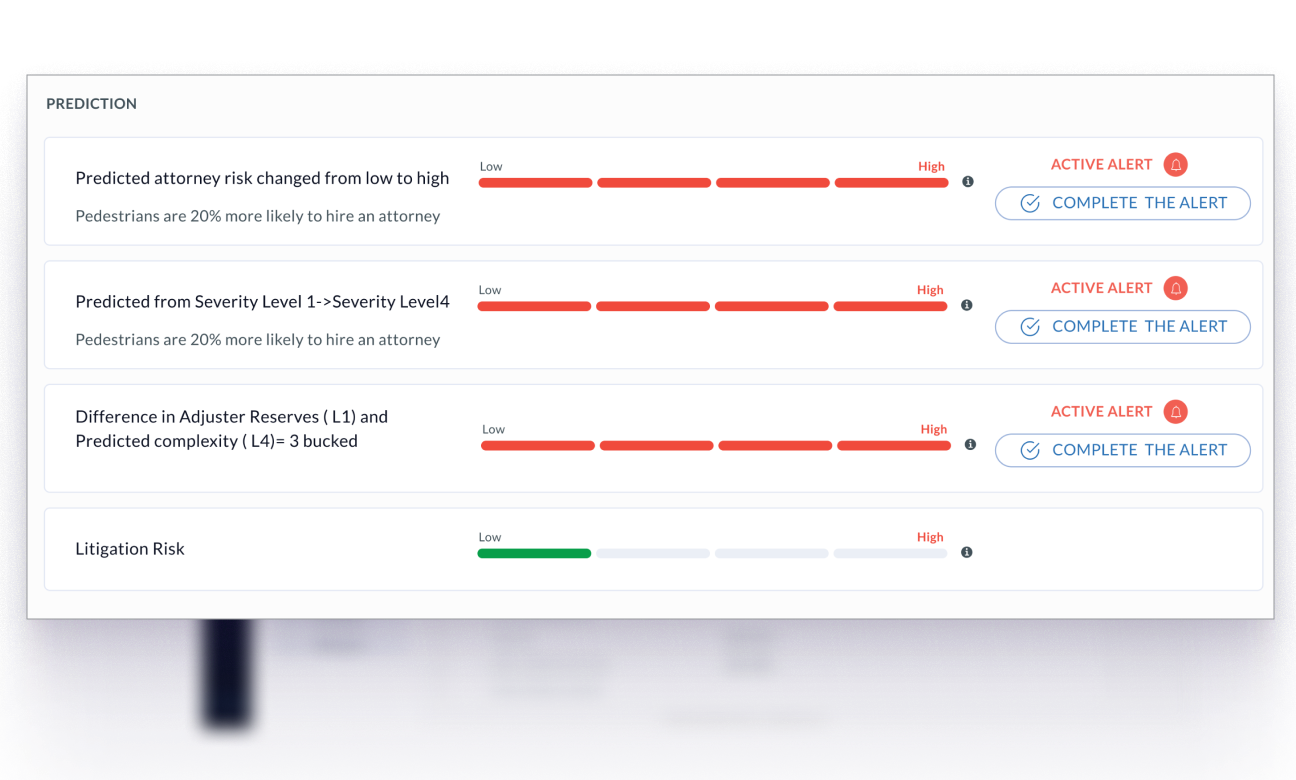

Using automated risk analysis, CLARA’s AI technology monitors millions of data points, looking for clues that might indicate the claim is about to escalate in severity and cost. CLARA Triage then alerts adjusters to take prompt action.

Accelerate Claim Closure with Accurate AI

CLARA’s severity models help identify reserve mismatches and opportunities to accelerate claim closure. Using AI claims review and automated risk analysis, CLARA monitors millions of data points to detect potential severity increases and cost spikes, and alerts adjusters for prompt action.

Drive Real Savings for Workers Compensation, Commercial Auto and General Liability

By using AI to spot problems before they happen, adjusters are better able to focus on reducing complexity, lowering claim costs, and helping workers return to work faster.

1 1

Key Benefits

- Predict severity and take action

- Automate risk identification and analysis

2 2

The Result?

- Improved productivity and closing ratios

- Lower indemnity expenses

- Identify valuable subrogation opportunities

3 3

Ideal For

- Claims professionals

- Risk managers

Prevent Claims Issues Before They Happen

CLARA Triage deploys in weeks with little IT effort

CLARA Triage has the flexibility to integrate with you

CLARA Triage is secure with annual certifications

Easy To Deploy

Our cloud-based platform can be up and running in 8-12 weeks after historical data is received, including model tuning, alert configuration, and hands-on training for adjusters.

Seamless Workflows

Adjusters can access claims directly via our cloud-based module at any time from any location, or flex their existing systems with our pre-built APIs for simple integration.

Security Is Our Priority

Rest easy with HIPAA compliance, annual SOC 2 certification, and data encryption that meets or exceeds industry standards in safeguarding your data.