Why CLARA?

Focus on Value

Insurance acumen

Constant Invention

Core Systems Integration

Cost Effective

Industry Leading Claims Data Base

Wondering where to start with augmented intelligence?

AI is a game-changer for your claims management strategy. But with all the noise surrounding the technology, it can feel overwhelming to get started.

Check out our ultimate guide to AI for casualty claims.

How It Works

Contribute:

Customer provide historical claims data to our leading Contributory Database Model that enables insights that are difficult for sole carriers to replicate.

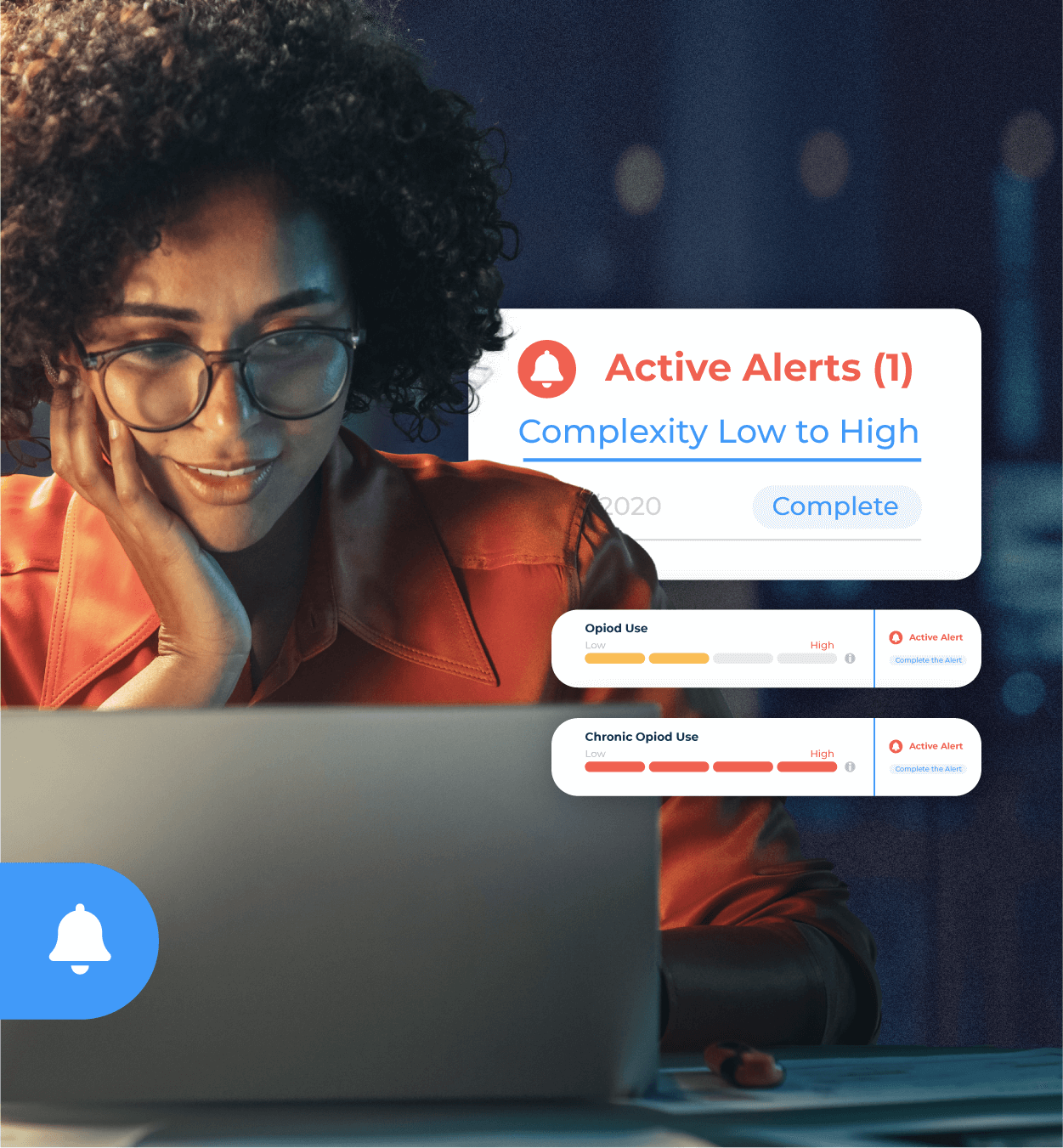

Analyze:

Our AI models go to work daily looking at any new data coming in and analyzing claims for opportunities to prevent loss cost escalation.

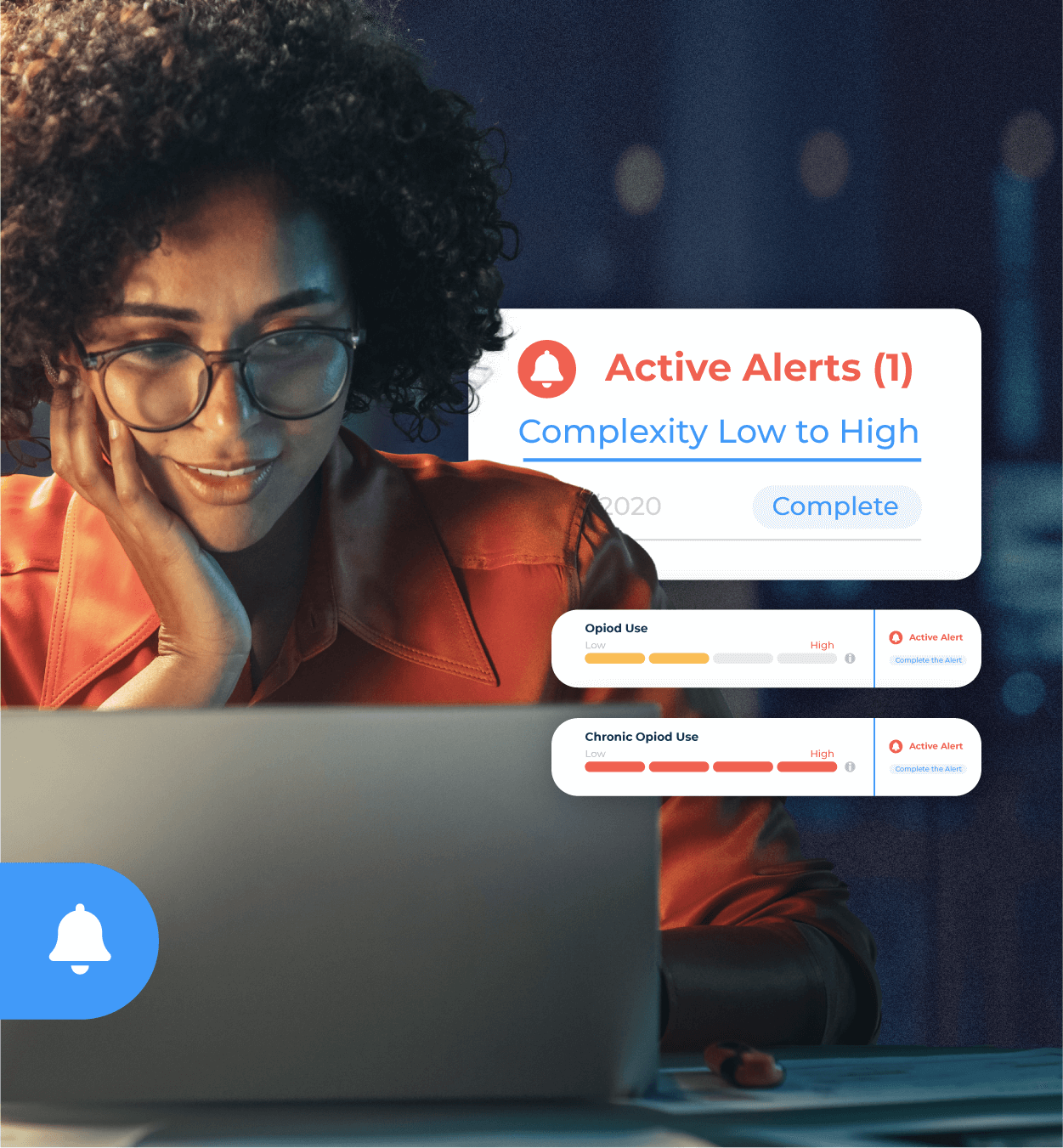

Alert & Take Action:

Claims teams receive alerts daily on which claims to focus on. Choose from a rich set of preset insights and alerts or work with CLARA to customize alerts that fit your workflows.

Who’s It For?

Carriers

Our carrier customers use CLARA to become data-informed for both in-house claims teams and with their TPA partners. CLARA’s tools work for claim leadership, adjusters, nurse case managers and defense counsel.

Self-Insured Enterprises

Fortune 500 organizations use CLARA to manage their claims exposure. Our augmented intelligence solutions work for both in-house and TPA claims management.

MGAs/MGUs

CLARA is the preferred casualty claims platform for MGAs/MGUs. Our AI platform grows with the MGA/MGU as they expand and take on more claims management responsibility. Grow market share with claims complexity modeling, TPA dashboards and improved collaboration, and industry benchmarking.

Third Party Administrators

TPA’s use CLARA at the request of their clients and even independently to drive the best claim outcomes for their customers.

Our Partners

We have strategic partners that improve the user experience and help drive accelerated value to our customers. Key partnerships include: