The Complex Landscape of Self-Insurance: Challenges for CFOs and Treasurers

Self-insured businesses operate without the safety net of insurance premiums, relying instead on their own funds to cover claims. While this model may sound straightforward—set aside funds for current and future claims—it’s anything but simple. As a CFO or Treasurer of a self-insured entity, you likely face several daunting challenges that can keep you up at night.

The Reality of Self-Insurance

By choosing self-insurance, businesses avoid premium payments, but they must maintain sufficient reserves to cover not only reported claims but also those that have been incurred but not yet reported (IBNR). This requires careful financial planning and risk management, making the decision to self-insure a complex one.

Challenge #1: Rising Litigation Rates and Nuclear Verdicts

One of the most pressing concerns for self-insured businesses is the increase in litigation rates and the emergence of “nuclear verdicts.” Defined as civil cases resulting in judgments exceeding $10 million, these verdicts have surged, particularly in sectors like medical liability and automotive. According to the U.S. Chamber of Commerce Institute for Legal Reform, the median nuclear verdict rose from $19.3 million in 2010 to $24.6 million in 2019—a staggering 27.5% increase during a period of only 17.2% inflation. A 2023 report from Clyde & Co. attributed this trend to growing anti-corporate sentiment, especially among younger jurors. For a self-insured business, a nuclear verdict can spell financial disaster.

Challenge #2: Inflation and Rising Costs of Claims

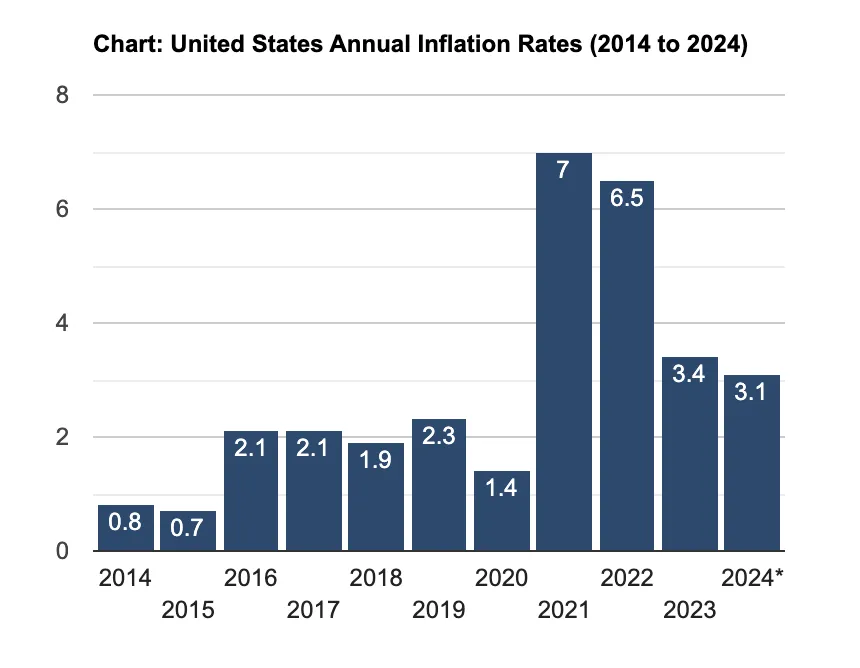

Inflation poses another significant challenge, particularly as the costs of medical care continue to climb. Higher expenses impact claims related to bodily injury, including Workers’ Compensation, Auto Bodily Injury, and General Liability claims. Even with inflation rates trending downward, the costs associated with these claims are on the rise. CFOs must carefully consider how much to reserve for open bodily injury claims and IBNR claims, making financial foresight crucial.

Challenge #3: Volatility in Claims and Loss Development

The unpredictability of claims adds another layer of complexity. Are there “sleeper” claims within your portfolio—those seemingly benign cases that may later require significant reserve increases? Identifying these claims before they escalate is essential, and having a proactive approach can save your organization from unexpected financial strain.

Challenge #4: Self-Administration vs. Outsourcing to Third-Party Administrators (TPAs)

Deciding whether to self-administer claims or outsource to a TPA presents another critical dilemma. While TPAs can provide structured contracts and monitoring services, assessing their effectiveness is vital. How often do you receive data updates? Are you aware of any sleeper claims that could be lurking in your caseload? Alternatively, self-administering claims poses its own challenges, such as attracting and retaining skilled claims professionals. With an aging workforce and a shortage of talent in the insurance industry, securing experienced adjusters is becoming increasingly difficult and costly.

Challenge #5: Navigating Regulatory and Legal Compliance

Lastly, self-insured businesses must navigate a labyrinth of regulations and compliance requirements that vary by state. Understanding these mandates and maintaining compliance is crucial to avoiding penalties and fines. With non-compliance leading to significant financial repercussions, diligent oversight is necessary to ensure that your claims processing adheres to all applicable laws.

Conclusion

Self-insurance can offer improved cash flow and greater control over claims, but it comes with its own set of challenges that require careful management. As a CFO or Treasurer, staying vigilant and proactive about these issues is key to ensuring the financial health and legal compliance of your self-insured business. By addressing these challenges head-on, you can safeguard your organization’s future and navigate the complexities of self-insurance with confidence.

Schedule a demo today to see CLARA’s AI solutions in action.